With banks and card issuers releasing credit and debit cards with chip technology, Biola is installing new card readers on campus that can read the new chip cards.

Reducing Counterfeiting

The technology within the microchip, which will become standard by 2017, was created to reduce counterfeiting in the form of duplicating original credit and debit cards and

“The chip has better security around it than the magnetic strip. [For] the magnetic strip, it’s fairly easy for someone to insert an additional reader into the swipe reader and then it reads your magnetic strip then they get the information [to] then create a new card,” said Lori Lambert, business systems manager.

Machine Installations

The new card readers are in the university’s cashier office and some have been installed in the university’s bookstore. The machines, however need certification from the card processor in order to read the new chip technology.

“The processing of the card payments has just taken a long time,” Lambert said.

She also mentioned this is another reason why many vendors are behind in the installation process. The machines will accept both cards with magnetic stripes and new chip technology. The new machines will have a slot that will require the owner of the card to insert and leave it in the machine rather than slide the magnetic strip.

Implemented in Europe

During the early 2000s, Europe implemented the new chip within credit and debit cards and the process became standard in Britain by 2006.

“With the chip it’s harder but not impossible, unfortunately to counterfeit. They have been using it for quite a while. So a lot of people are saying that the United States is behind the times,” Lambert said.

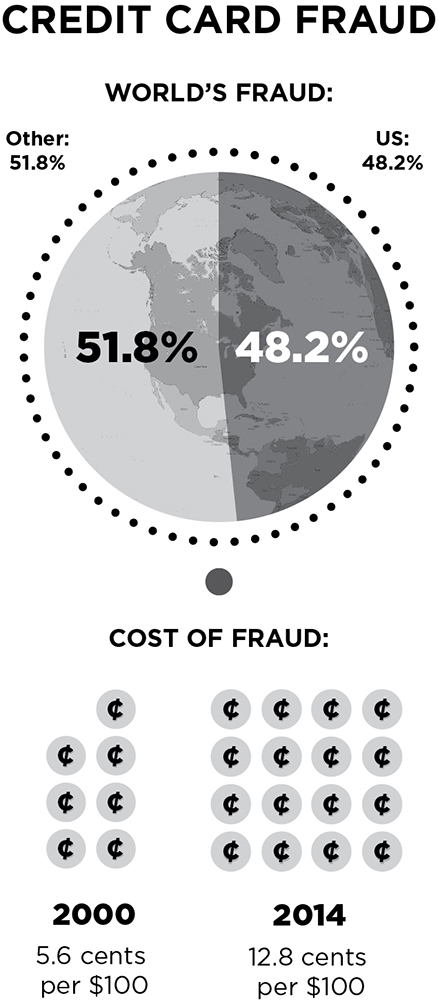

According to a CEB TowerGroup report, counterfeit fraud went from 26 percent in 2006 to 10 percent in 2013 since Britain implemented the EMV technology.

Hindering Businesses

The expense of the new machines, however, plays a major factor in hindering businesses, like Bon Appetit eateries.

“It’s fairly expensive to be changing the technology because the card machines have to be changed to read the chip, chips have to be installed and then the cards and the card issuers need to work together in different ways and get those devices certified and things like that so it’s fairly expensive,” Lambert said.

Students like sophomore biology major Hailey Mayweather are more concerned with the security of leaving a card in a slot for a longer period of time.

“I don’t really want it honestly. The fact that you leave in the thing for so long, it just seems less secure to me and I don’t feel like going through the process of getting a new card anyway. It seems like you’re losing more privacy by trusting people with more of your information… It’s probably not as secure as it seems to be,” Mayweather said.

Potentially Worth it

Others are not too familiar with the new card technology, but lean on its purpose of providing better protection from fraud.

“It seems interesting that it can be done like that. I can see that if it helps reduce fraud, the extra time it takes would be worth it,” said Roger Hobbs Jr., sophomore intercultural studies major.