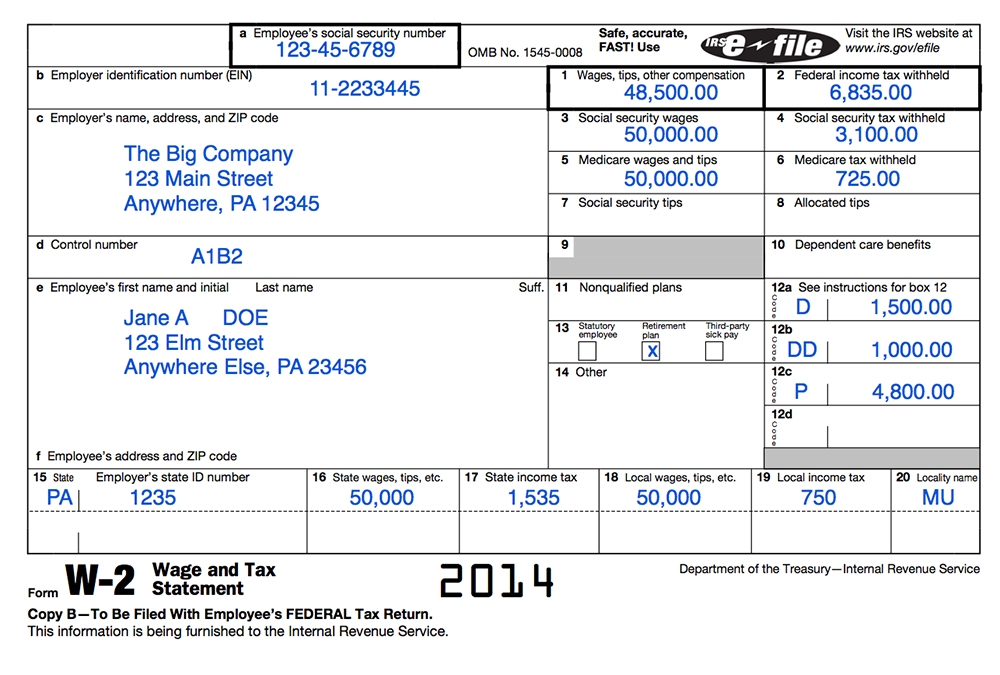

Students workers on campus claim themselves as dependents during tax season and give parents their Form W-2s. The national filing deadline for U.S. residents on federal income tax returns was April 15 or on the following day that is not a weekend or holiday.

The accounting department gives out Form W-2s to students, but ultimately urges them to speak to a tax advisor if they have any questions filling out other tax forms. Students must email Payroll to ask any questions they may have regarding their Form W-2s.

Freshman engineering physics major Adrian Escobar has worked at the Caf for two semesters and claims dependent on his tax forms.

“I [fill out taxes] on my own. Well, I do have my mentor but she only helped me once,” Escobar said.

Other students rely on their parents to help them file their taxes. Juan Santacruz, freshman biochemistry major, has worked at the Learning Center since February 2015 and has not filed taxes yet, but he would still rely on his parents to help him.

“I would probably need help to file my taxes,” Santacruz said. “I’d say [I would go to] my parents and they could lend me advice or help me.”

While most students rely on their parents for assistance, freshman anthropology major Kristyna Hughes will only be relying on her father for one more year before she begins filing her taxes as independent.

“I know my dad’s talking about next year we’re going to change it so I’m independent so that I can get better tax returns, but previous years, he got better tax returns than I would have so that was probably the best benefit,” Hughes said.

Hughes has worked at the library since the beginning of the semester, but worked as a tutor at the Biola Youth Academic Center during fall of 2014. Her father uses online tax preps to get them through the entire process.

“We usually use Turbotax and just kinda fill it out from there,” Hughes said.

Hughes said that she would still return to her father the first time she filed independent just to make sure she did everything correctly.