Students doubtful about government’s loan forgiveness program

The White House implements new programs for student loan debt.

September 17, 2014

Students believe attempts by the White House to create new options for students with income-based repayment programs for student loan debt fall short.

Last November, the White House sent out experimental email alerts to college students throughout the nation to help them construct an easier way to pay off debt through income-based repayment programs. Though this program is intended for any student, sending emails to students with loans delinquent by 90 to 180 days led to a large increase in completed repayment application, according to the White House website. Even though the White House has not released a start date, it plans to give the program another try.

Many students who take out either loans, grants or both express a wide range of reactions about the email alert program. The most generous plan for the income-based programs is known as Pay As You Earn. This caps students monthly pay at 10 percent of their income and offers debt forgiveness after twenty years.

“[I am interested] just because I wouldn’t have to pay for school,” said Noemi Nesta, freshman elementary education major.

The idea of the program sparks interest for some students, but many believe that the program will not help them manage their debt.

“If it is actually going to happen, yes. If [the government] is just informing me, no, because it’s not going to happen,” said Megan Clark, a junior biochemistry major.

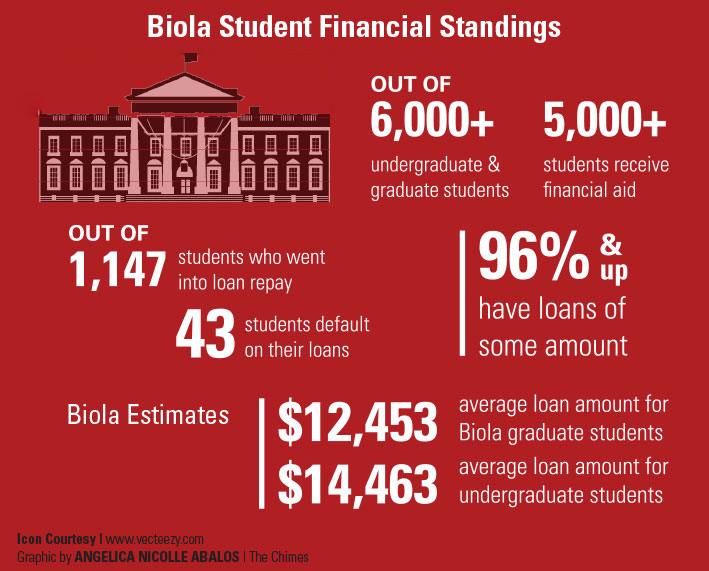

Out of over 6,000 undergraduate and graduate students, over 5,000 students receive financial aid according to Jonathan Seruyange, associate director of the financial aid office — nearly 72 percent of the student body, according to Biola University. Out of the students receiving aid, over 96 percent have loans of some amount.

Biola's estimates that out of the 1,147 students who went into loan repay, 43 students default on their loans, according to Seruyange.

The average loan amount for Biola graduate students totals as nearly $12,453, but the average loan amount for undergraduate students adds up to about $14,463, according to Seruyange. This number includes the Parent Plus Loans taken out on students' behalves by their parents, Seruyange said.

However, there is a lack of information about the entire program, according to an article from The Chronicle of Higher Education. Some students respond to this lack of information with distrust.

“If anything I would scoff at it, but yeah sure. It would give me something to laugh at,” said junior nursing major Kimmie Marˊin.