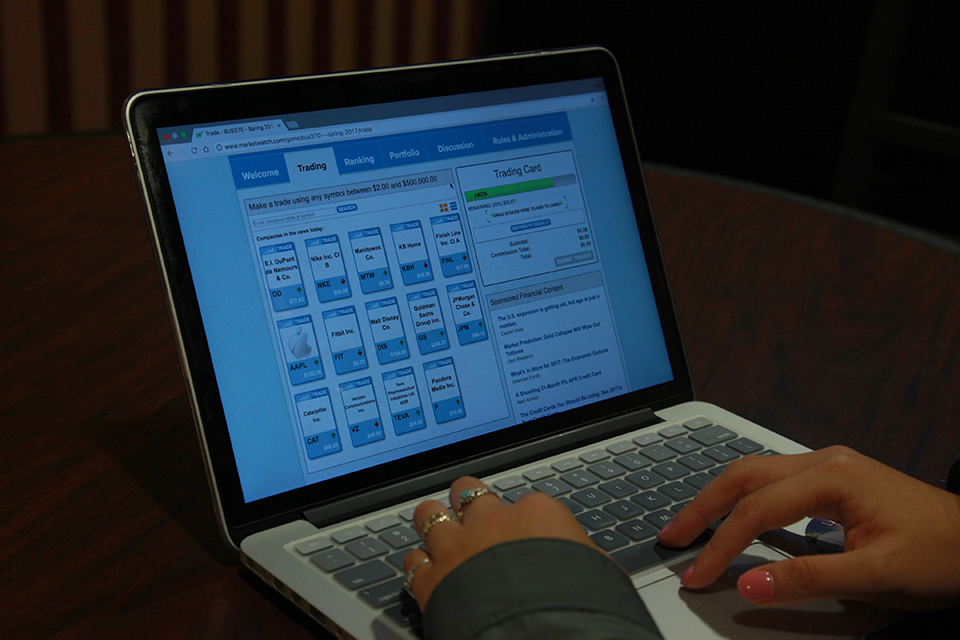

As millennials and college students, it is difficult to look past obtaining a job and unburdening ourselves from massive student debt. Yet as President Donald Trump begins to set up his administration, he has begun to attack one seemingly flawless principle: the fiduciary rule. A fiduciary is a person who is bound ethically to act in another’s best interest. Thus, the fiduciary rule requires financial advisers put their client’s interest foremost. The rule was emplaced by the Obama administration in order to help weed out corruption within Wall Street.

Billions in losses

The Trump administration has delayed this rule, arguing it unfairly limits consumers’ choices and restricts brokers’ ability to charge commissions. Former president of Goldman Sachs, now current director of the National Economic Council, Gary Cohn, called it a “bad rule” and compared it to “putting only healthy food on the menu, because unhealthy food tastes good but you still shouldn’t eat it because you might die younger.” This rather absurd analogy does not stand up to the simple principles of the fiduciary rule. Yet, it is not surprising the former head of an investment firm would rather have his company make money than its clients have the best advice. If the rule remains, it would cost the financial industry up to $20 billion in losses of revenue while clients would see the same amount in returns.

It is a straightforward principle when giving clients advice about retirement funds, investment advisers and insurance agents must put their clients best interests first. Any human being with the most basic sense of morals can understand why this rule is needed and why attacking it is foolish. The practice of letting the client know their best interest is placed second behind the interest of the firm’s is stunning. Yet, Wall Street has worked on the principle of putting their firms’ interest before the clients’ by pushing clients toward more expensive funds and focusing on their own commissions.

A client-first mentality

If the fiduciary rule is somehow repealed, it will not be the end for the principles it was meant to implement. Investors want people they can trust who have their best interests at heart. Good, honest firms will embrace the simple principle of doing what is best for their clients. They have taken steps to eliminate front-end commissions, which give agents incentives to push higher priced funds, and move to annual asset charges on retirement accounts. The client-first mentality will remain despite President Trump’s efforts to eliminate its enforcement.

Millennials will benefit from the fiduciary rule with its lower fees over time for advice. They also benefit from truthful firms taking advantage of the delaying of this rule and the conflict that has come with it. The sooner advisers are able to develop credible relationships with younger clientele, the sooner a sound financial future will be obtained. The attack on the fiduciary rule will only develop an even more divisive relationship with Wall Street and members of the financial industry. As a nation, we are already politically divided and economically stratified. There is a vast amount of hatred for our fellow Americans, and there is no need to further this hatred by attacking a person’s financial future, especially the upcoming generations.