Left and right, students continue to leave four-year universities in favor of community colleges or simply not attending universities at all. For some, they question how they could ever pay for a college education. Some choose to work for many years before attending a university so they can save up and pay for it on their own. Some struggle to find open spots at crowded community colleges with the hope of transferring to a university later on in their education. Others put their faith in scholarships, working into the middle of the night doing homework in an attempt to get the chance of receiving a full-ride to the college of their dreams. In many cases, students and economic analysts alike have begun asking themselves if college is even worth it anymore.

High Cost

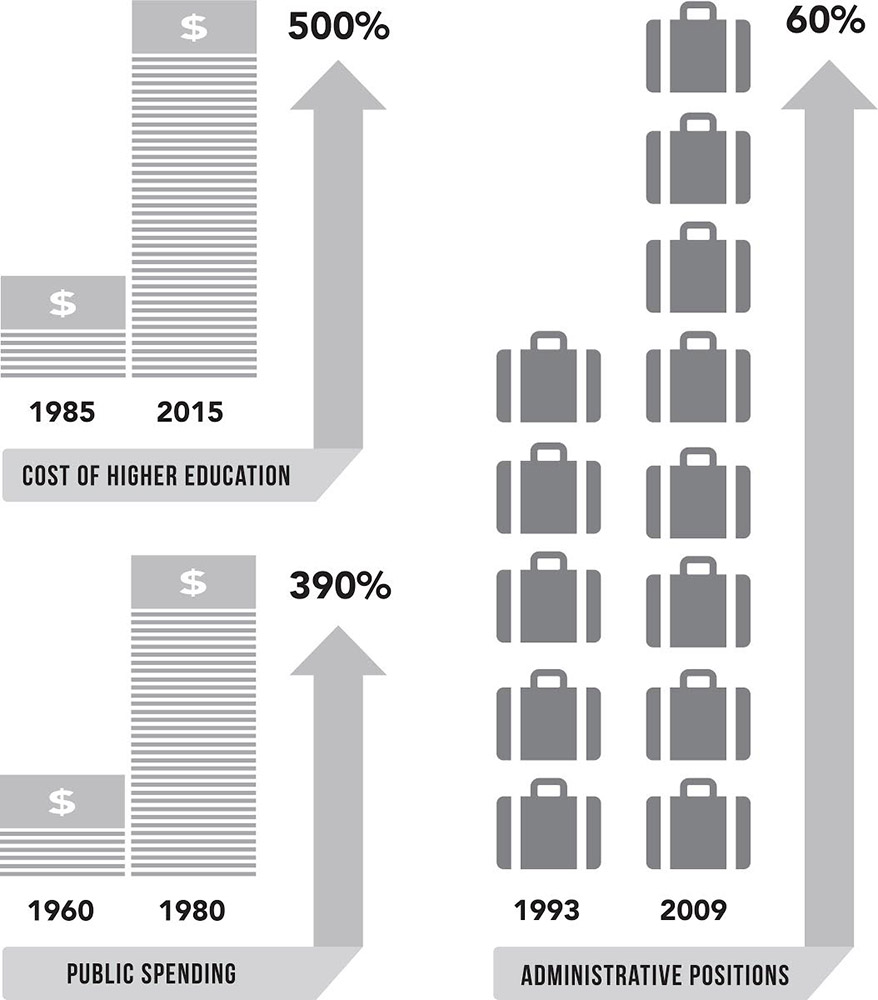

The cost of higher education in America has increased by over 500 percent since 1985, according to Bloomberg Business. When they were young adults, baby boomers worked their way through college with part-time jobs, but as the price continues to skyrocket, this prospect becomes less and less feasible. According the College Board, the average price tag per year for four-year public universities ranges between over $9,000 for in-state students and over $22,000 for out-of-state students. For private universities, the average per year cost of tuition amounts to over $30,000. These are modest estimates according to The Economist, as some universities cost over $60,000 per year, and this does not necessarily include housing, books, supplies or food.

The college board will say the cost of higher education is not as big of a mountain as it appears, claiming students do not have to pay the sticker price of college because of their access to scholarships and grants. However, 10 percent of borrowers default on their loans within the first two years according to the New York Times, and they will tell you a different story altogether.

An Incorrect Perspective

Some people claim this rise in the disproportionate cost of education in comparison with the rise in the cost of other goods stems from a decrease in federal subsidies for public universities. With a cut in public funding, the universities would have to seek financial support from other sources like tuition and other fees.

However, in reality, this idea could not lie farther from the truth. In fact, public spending has actually increased tremendously over the years, rising approximately 390 percent between the years 1960 and 1980, according to the New York Times. This problem of the high college tuition cannot simply be solved by putting more money into the system. The government tried that and failed. Rather, we must stop treating education like a commodity.

Excess Administration

The real financial burden comes not from highly paid professors or a shortage of public funds, but rather from an excess of administrative positions created in an attempt to compete with other universities. According to the Department of Education data, between 1993 and 2009, the number of administrative positions at colleges and universities grew by 60 percent, which is 10 times the rate of growth of tenured faculty positions according to the New York Times.

Students are not the only ones competing for spots at universities. Universities that compete with each other for the students and these administrators’ jobs often make the school more accommodating or marketable to prospective students. This is not inherently an issue, but when this accommodation of students levies a greater burden on the students they want to feel more at home, it becomes counterintuitive. Politicians and school administrators alike must start reevaluating what is helping and what is hurting their students.